In the past few years, particularly since 2017, thanks to changes in the legislative environment, and of course, the pandemic, we’ve seen the rise of various tax-avoidance schemes and shady organisations calling themselves umbrellas that target contractors. Although some of these schemes may call themselves umbrella companies, they are certainly not.

The IR35 legislation reform has had a significant impact on freelancers seeking umbrella employers first back in 2017 through the public sector reform and thein in 2021 in the private sector. The Government’s attempt to crack down on “disguised employment” drove freelance contractors to sign up with an umbrella company gave way to criminal enterprises to line their pockets with taxpayer’s money.

To gain a better understanding of how these fraudulent companies work, first, it’s essential to look at what an umbrella company is.

Umbrella Company – What is it, and how does it work?

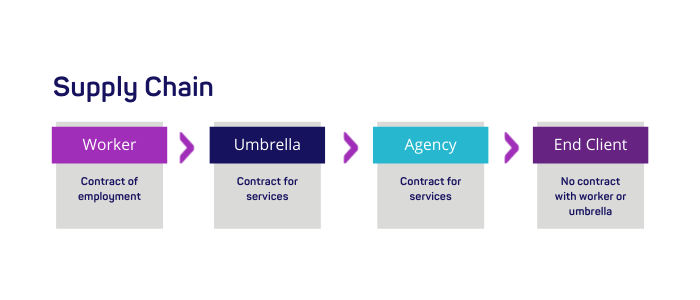

The primary function of an umbrella company is to organise payments for fix-term work undertaken by independent contractors. The umbrella enters into an employment contract with the worker and a service contract with the agency.

An umbrella firm enables the contractor to retain the flexibility of freelance work and consolidate the income into a single pay package with the continuity of employment with all statutory rights and benefits.

When signing up with an umbrella company, you become one of its employees, with it acting as an intermediary between you and your agency or directly with your end client if no agency is involved. As an employee, you will receive a full overarching employment contract and have full employment rights like any other worker.

Mini Umbrella Companies – What are they and how to spot them?

Most recently featured in the news are the so-called mini umbrella companies using the blueprint of the real deal and posing as one to become part of the supply chain.

The MUC model is an employment intermediary model. The fraud is based on the abuse of two Government incentives aimed at small businesses – the VAT Flat Rate Scheme and the Employment Allowance.

MUC fraud can be found in supply chains whenever temporary labour is used, which historically would have been paid by an employment agency or an umbrella company. The MUC fraud model’s simplest form involves splitting up a workforce into hundreds or thousands of small limited companies set up solely to enable the fraud.

For employees, who are unaware of these arrangements, this model can result in the loss of some employment rights. Workers in MUCs are usually unaware of who their employer is, and they can be moved regularly between MUCs to help maximise profits from the fraud.

There are some common features that businesses might come across during their regular Due Diligence checks. Information from sources such as the Companies House register might help spot warning signs when completing the quarterly Employment Intermediary Reports or the Key Information Document for Workers.

- Unusual company name – Often, multiple companies are set up around the same time, which have a similar or unusual name. These companies are often registered at an address that does not seem suitable for the types of business activities.

- Unrelated business activity description – Do the nature of the business activities described in the Companies House entries seem compatible with the services provided by the workers?

- Directors are foreign nationals – Often, foreign nationals are appointed as directors when a MUC is formed or can replace a temporary UK resident director after a short time. Usually, the directors will have no prior experience in the UK labour supply industry.

- Unusually high movement of workers – Are workers moved between different employers who meet the above criteria for being MUCs on a fairly frequent basis?

- Very short-lived businesses – The individual MUCs have a relatively short lifespan (often less than 18 months) before being allowed to be dissolved by Companies House due to their failure to meet their filing obligations. New MUCs will then take their place in the supply chain.

As the MUCs sit low down in the supply chain so it may be challenging to spot them. Remaining vigilant therefore is essential, especially where the employer of the worker is not the Umbrella Company they may have a contract with.

How to find a compliant umbrella provider?

Look out for one with a good track record and one that carries accreditation from a trade body like FCSA (The Freelancer & Contractor Services Association).

All FCSA Accredited Members are tested annually against the FCSA Codes of Compliance by independent, carefully selected assessors. The assessors are top-tier regulated accountants and solicitors bound by their professional standards and code of conduct and are independent of the FCSA.

No FCSA Accredited Member is allowed to operate Offshore Schemes, Loan Schemes, Trusts, Managed Services Companies Schemes, Pay-day-by-Pay models, or similar.

A genuine compliant umbrella company will:

- Pay over 100% of your pay through PAYE

- Employ you

- Allow you to work with multiple end-clients and consolidate your pay

- Give you full employment rights

For additional resources, look at HMRC’s guidance on undertaking robust Due Diligence, which can be found here: The supply chain due diligence principles.

Why work with SmartWork?

SmartWork is an accredited FCSA member, and so we undergo a yearly audit to demonstrate full compliance with the trade body’s strict code of conduct.

Our umbrella package is provided with a host of additional benefits:

- We process statutory sick pay, maternity/paternity and holiday pay and can assist you with mortgages advice and references.

- We cover you for all of your work-based insurances, including Professional Indemnity and Employers/Public Liability.

- Our personalised service provides each of our workers with a dedicated account manager

- The intuitive SmartWork portal lets our contractors upload timesheets, submit expenses and e-sign documents easily.

As always, if you’d like to get in touch with SmartWork, please feel free to call us on 0800 434 6446 or send us an e-mail at info@smartwork.com. To get notified every time we publish a guide or a blog post please follow us on LinkedIn or Twitter.